Underwriting is a process lenders use to assess risk before agreeing to approve a loan. The underwriting process verifies that the borrowers, the property and the documentation all meet the lender’s requirements for the requested mortgage.

A lender’s underwriter will typically verify the borrower’s income and check their credit score with the major credit bureaus. The underwriter may request additional information on any items that stand out during this review.

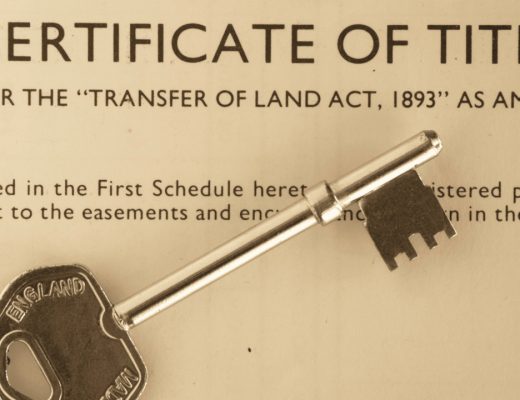

An appraisal is typically ordered to determine the true value and condition of the collateral property.

The history of the property’s past ownership is also researched to ensure that there are no unpaid liens and to verify the current ownership of the property.

In some cases, the lender may require a buyer to verify property boundaries, or require verification that the property is not located in a flood zone.

Always respond promptly and honestly to any requests from your lender’s underwriter since the underwriter makes the final decision on whether to approve or decline a loan.