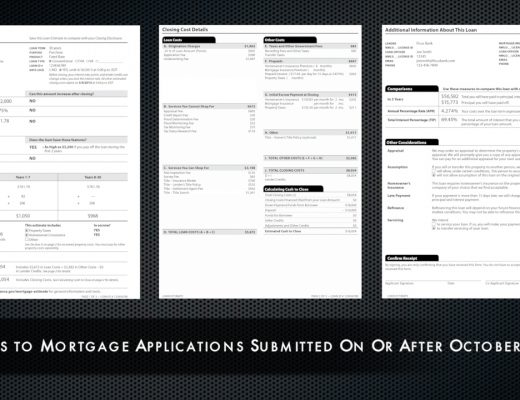

New disclosure forms for mortgage transactions have been created by the federal government’s Consumer Financial Protection Bureau. Lenders are required to give consumers these forms when they apply for a mortgage.…

Buyers

-

-

Open houses provide an excellent opportunity to view homes in a relaxed atmosphere. You get a feel for the market, can ask the REALTOR® questions, and can also ask yourself, “Is…

-

Finding a qualified, professional remodeling contractor doesn’t have to be a difficult task. The following guidelines will make the selection process easier. Employ a contractor with an established business in your…

-

The “closing” is the last step in a real estate transaction. Depending on your state’s laws, you may or may not be required to have an attorney represent you at the…

-

The home buying process can be a stressful experience, especially for first time home buyers. Let’s take a look at some common home buying myths: A 30 year mortgage is always…

-

Considering buying your first home? You’re probably trying to decide it fit is better to buy or rent. The benefits of owning a home become much clearer as you compare the…

-

One of the biggest hurdles for many prospective home buyers is finding a way to accumulate enough money for a down payment. Here are some suggestions on ways to raise the…

-

If you are a first time home buyer, here are some banking terms you should become familiar with: Interest Rate. The interest rate is the amount a lender charges a borrower…

-

Is a fixed or adjustable rate mortgage right for you? Let’s take a look at the pros and cons… A fixed rate mortgage has the same interest rate and monthly payment…

-

Your credit history is an important factor that’s taken into consideration when you apply for a mortgage – so making sure the information in your credit report is accurate is essential.…