Are you looking for maintenance-free, luxurious living? Tyrone Leslie, President/Owner of Berkshire Hathaway HomeServices Premier Properties and Heritage Homes, discusses the progress and amenities of The Aspens at Timber Creek! Learn…

Buyers

-

-

Lenders dissect the entire credit history of a potential client with strict attention to income, credit, collateral and assets. Of the four, assets are perhaps the least discussed, yet may be…

-

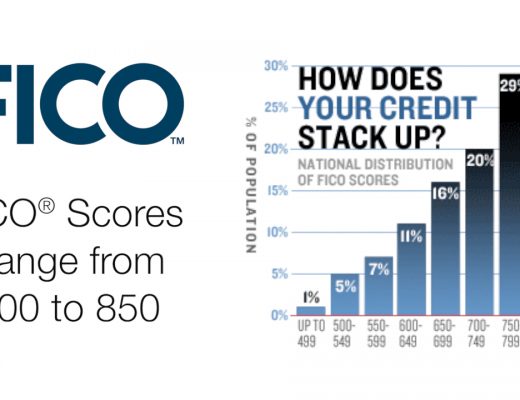

When you apply for credit – whether for a car loan, a credit card, or a mortgage – lenders want to know what risk they’ll be taking by loaning you money.…

-

Do you know what you need before you start looking for a home? Jessica Stark, licensed Berkshire Hathaway HomeServices Premier Properties REALTOR®, discusses the importance of a pre-approval when buying a…

-

Did you know that only real estate licensees who are members of the National Association of REALTORS® are properly called REALTORS®? REALTORS® subscribe to a strict Code of Ethics and are…

-

Katie Johansen, licensed Berkshire Hathaway HomeServices Premier Properties REALTOR®, discusses #GoodToKnow factors such as schools, homes styles and amenities that should be considered when choosing a neighborhood!…

-

Which is better: A 30-year fixed-rate mortgage or go for a lower-interest 15-year one? Typically, 15-year mortgage allows you to pay off your mortgage quicker and save a significant chunk of…

-

If you are self-employed, it can be a little harder for you to get a mortgage than someone who is an employee of a company that receives a regular paycheck and…

-

Federal law requires each of the three nationwide consumer credit reporting companies – Equifax, Experian and TransUnion – to give you a free credit report every 12 months if you ask…

-

Mari Santoyo Perry, Heritage Homes New Home Sales Specialist and licensed Berkshire Hathaway HomeServices Premier Properties REALTOR®, discusses the new construction “showcase” homes available from Heritage Homes!…