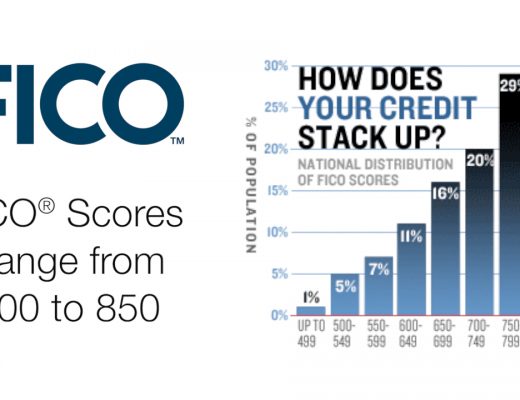

When you apply for credit – whether for a car loan, a credit card, or a mortgage – lenders want to know what risk they’ll be taking by loaning you money.…

mortgage

-

-

Which is better: A 30-year fixed-rate mortgage or go for a lower-interest 15-year one? Typically, 15-year mortgage allows you to pay off your mortgage quicker and save a significant chunk of…

-

If you are self-employed, it can be a little harder for you to get a mortgage than someone who is an employee of a company that receives a regular paycheck and…

-

A reverse mortgage is a type of loan available to homeowners age 62 years or older. It’s called a “reverse” mortgage because the lender makes payments to the borrower. With a…

-

The mortgage business is highly competitive with many loan options to choose from. Before selecting a lender, or a loan, here are some questions you should be asking… What types of…

-

In terms of your mortgage, a point is an additional loan fee that is paid to the lender in exchange for a lower interest rate. It’s called “buying down,” and it…

-

A bridge loan is basically a short term loan that a homeowner can use to “bridge the gap” between two transactions… typically the buying of one house and the selling of…

-

The Real Estate Settlement Procedures Act (or RESPA) is a consumer protection statute relating to real estate transactions. RESPA requires that consumers receive disclosures at various times in the transaction –…

-

If you made a down payment of less than 20% when you purchased your home, your lender likely required Private Mortgage Insurance. This protects the lender against a loss in the…

-

Hear from Julie Fournier, licensed Berkshire Hathaway HomeServices Premier Properties REALTOR®, and Wade Vogl, Northwestern Bank real estate lender, on the first steps when purchasing a home. These steps include getting…