When you are at the closing of a real estate transaction you may hear the term “prepaid interest.” Here is what it means… Prepaid interest charges are charges due at closing for…

loan

-

-

When you apply for a mortgage you might come across the abbreviation “PITI.” Here’s what it means… PITI stands for Principal, Interest, Taxes and Insurance. Mortgage lenders want to be sure…

-

Have you ever wondered what the difference is between a mortgage’s interest rate and its annual percentage rate? Here’s the answer… The interest rate is the cost you’ll pay each year…

-

The Federal Housing Administration (or “FHA”) was established in 1934 to advance opportunities for Americans to own homes. The FHA provides private lenders with mortgage insurance that gives them the security…

-

Homeowners who are planning to improve their home, looking for relief from debt, or making a major purchase should consider a home equity loan. The equity in your home is the…

-

If you are looking to buy a home but plan to make a down payment of less than 20%, most lenders will require private mortgage insurance. Mortgage insurance protects the lender…

-

When buying a home your lenders looks at your income, assets and down payment. They’ll also want to know about your liabilities and other financial obligations. This includes things like credit…

-

Closing costs are fees buyers often pay related to the purchase of a home. Typical closing costs include things like: Mortgage origination fees or loan discount points paid to a lender.…

-

If you are a first time home buyer, here are some banking terms you should become familiar with: Interest Rate. The interest rate is the amount a lender charges a borrower…

-

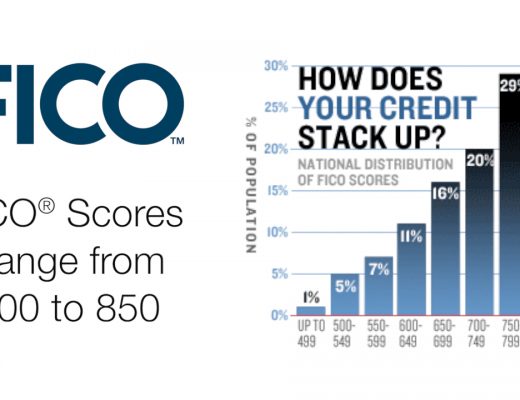

When you apply for credit – whether for a car loan, a credit card, or a mortgage – lenders want to know what risk they’ll be taking by loaning you money.…