When buying a home your lenders looks at your income, assets and down payment. They’ll also want to know about your liabilities and other financial obligations. This includes things like credit…

mortgage

-

-

When selling your home, here are common closing costs to keep in mind that will affect your net proceeds. The REALTOR® commission – typically a percentage of the sale price. The…

-

Deciding to purchase your first home is exciting…. but you probably also have lots of questions! Here are some tips for first time home buyers. Start by checking your credit score.…

-

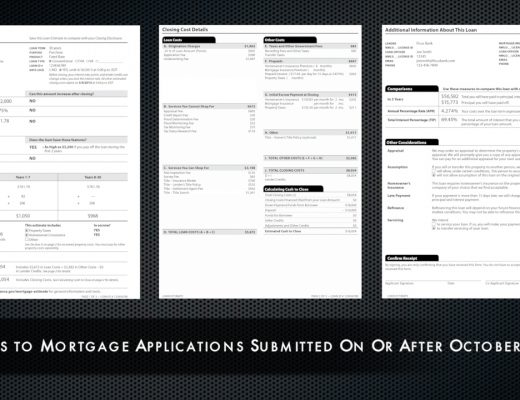

New disclosure forms for mortgage transactions have been created by the federal government’s Consumer Financial Protection Bureau. Lenders are required to give consumers these forms when they apply for a mortgage.…

-

The home buying process can be a stressful experience, especially for first time home buyers. Let’s take a look at some common home buying myths: A 30 year mortgage is always…

-

Considering buying your first home? You’re probably trying to decide it fit is better to buy or rent. The benefits of owning a home become much clearer as you compare the…

-

If you are a first time home buyer, here are some banking terms you should become familiar with: Interest Rate. The interest rate is the amount a lender charges a borrower…

-

Is a fixed or adjustable rate mortgage right for you? Let’s take a look at the pros and cons… A fixed rate mortgage has the same interest rate and monthly payment…

-

Your credit history is an important factor that’s taken into consideration when you apply for a mortgage – so making sure the information in your credit report is accurate is essential.…

-

Failure to pay property taxes when due can lead to serious consequences… fines, interest, property liens or even foreclosure. Most lenders require monthly mortgage payments to include an escrow for one…